What is the best 401k company? Encinitas Daily News

The average age of retirement. According to the government's Retirement Income Review released in November 2020, the average age of retirement in Australia is currently between the ages of 62 and 65, with women tending to retire one to three years before men. But things are changing. For a variety of reasons, today's retirees are likely to.

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance

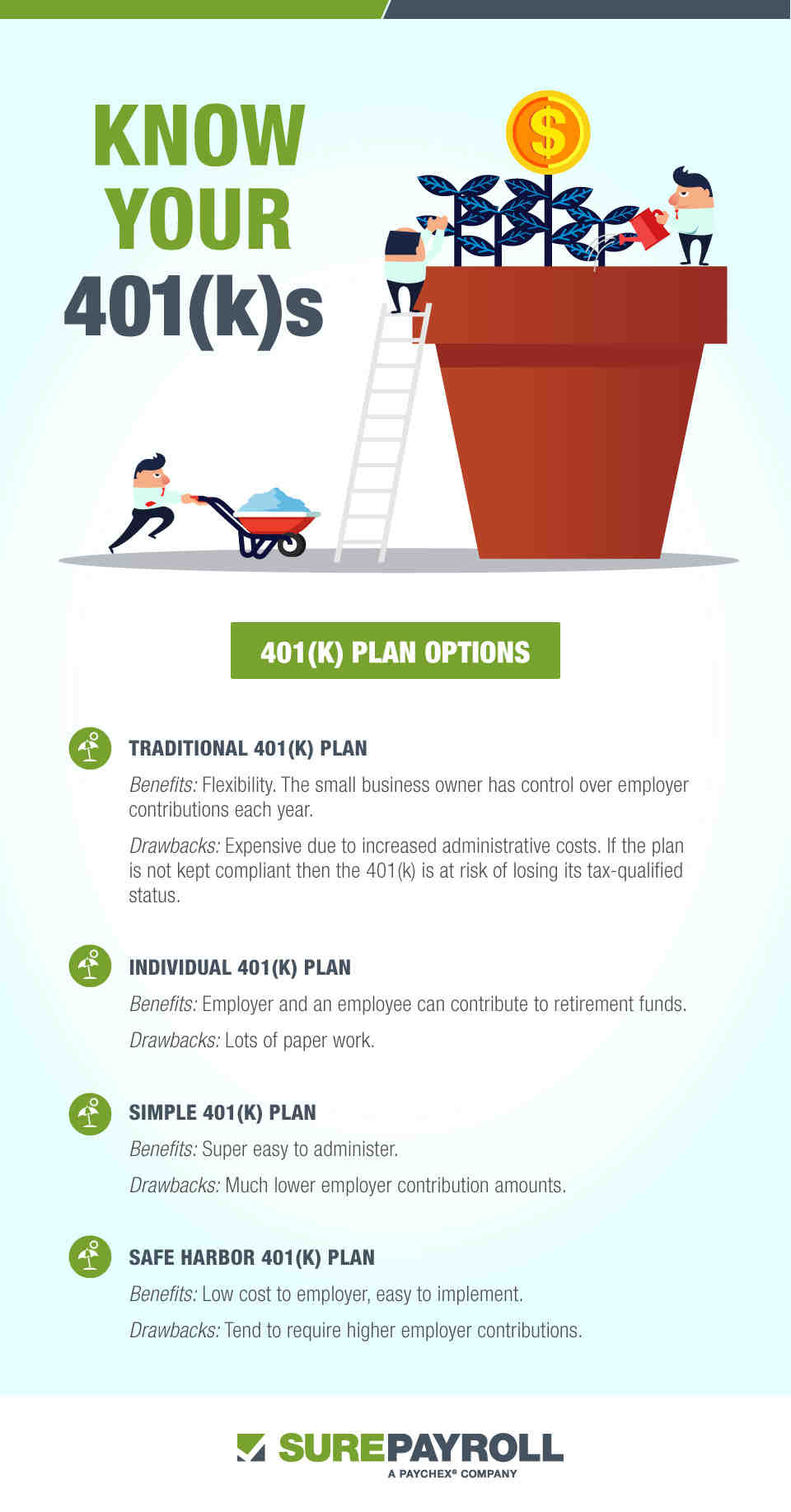

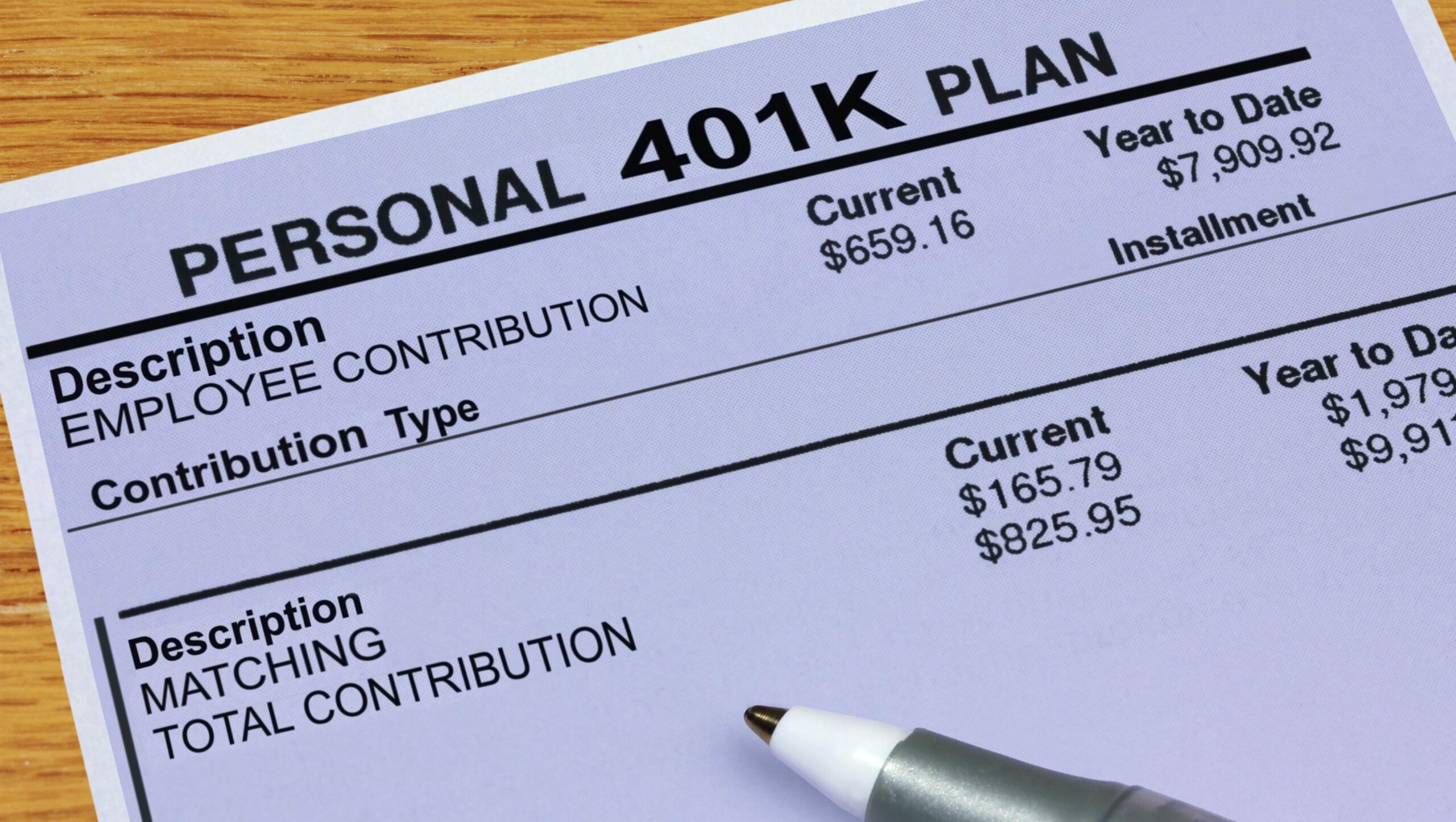

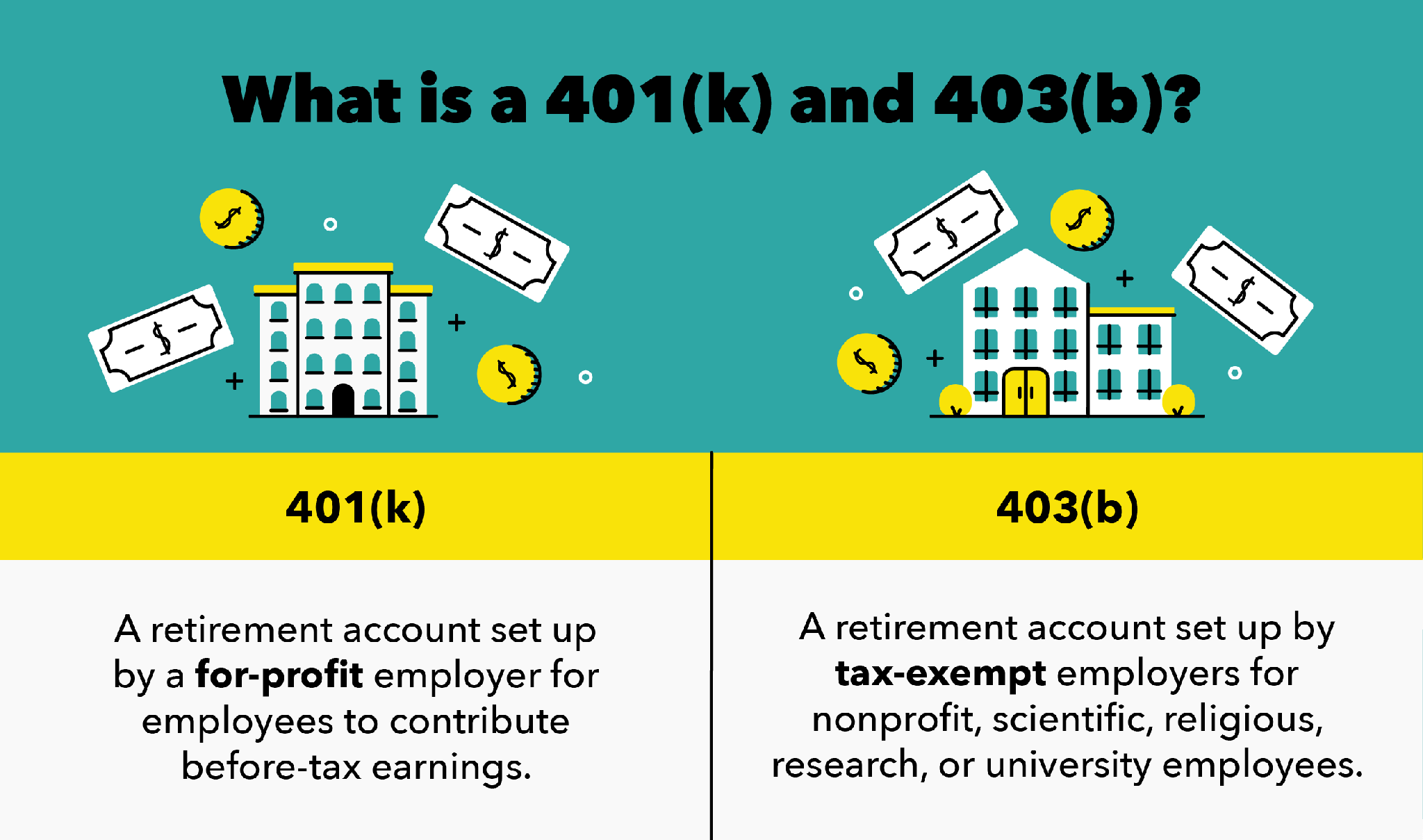

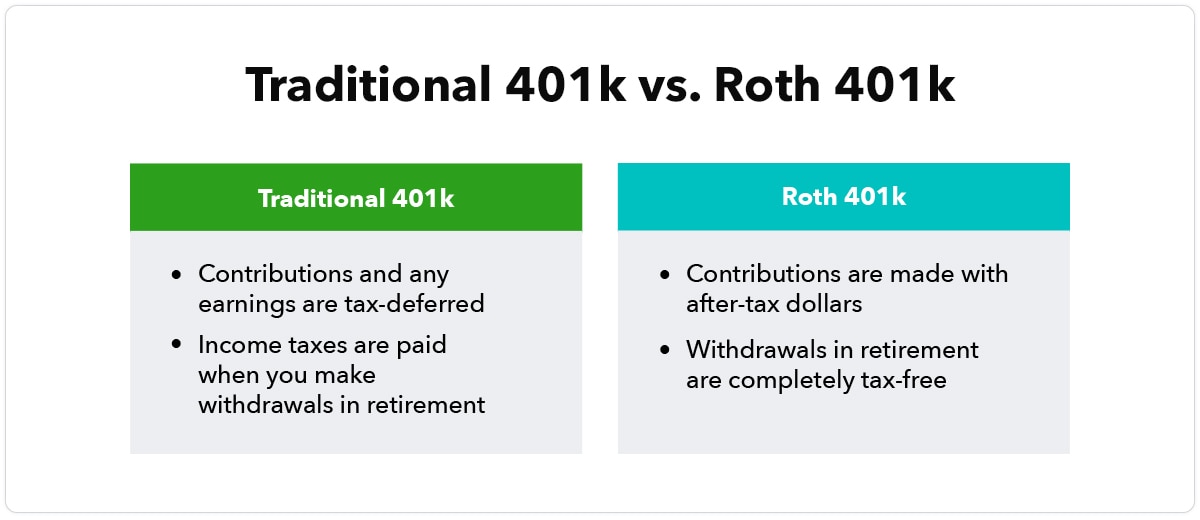

A 401 (k) is a retirement savings plan offered by employers to their employees. It allows individuals to contribute a portion of their pre-tax income into a dedicated retirement account. These contributions are typically invested in a range of investment options, such as shares, bonds, and mutual funds, with the goal of growing the funds over.

What is a 401k? All you need to know YouTube

The average cost of a one-bedroom apartment in the city center of Melbourne is $1,177 per month, and the average cost for a one-bedroom apartment in the suburbs of Melbourne is $1,004 per month. The bottom line: Whether your housing costs are cheaper than in the United States depends on where you are now and where in Australia you plan to settle.

What is the 401(K) Plan? How to be vested in it? Tricky Finance

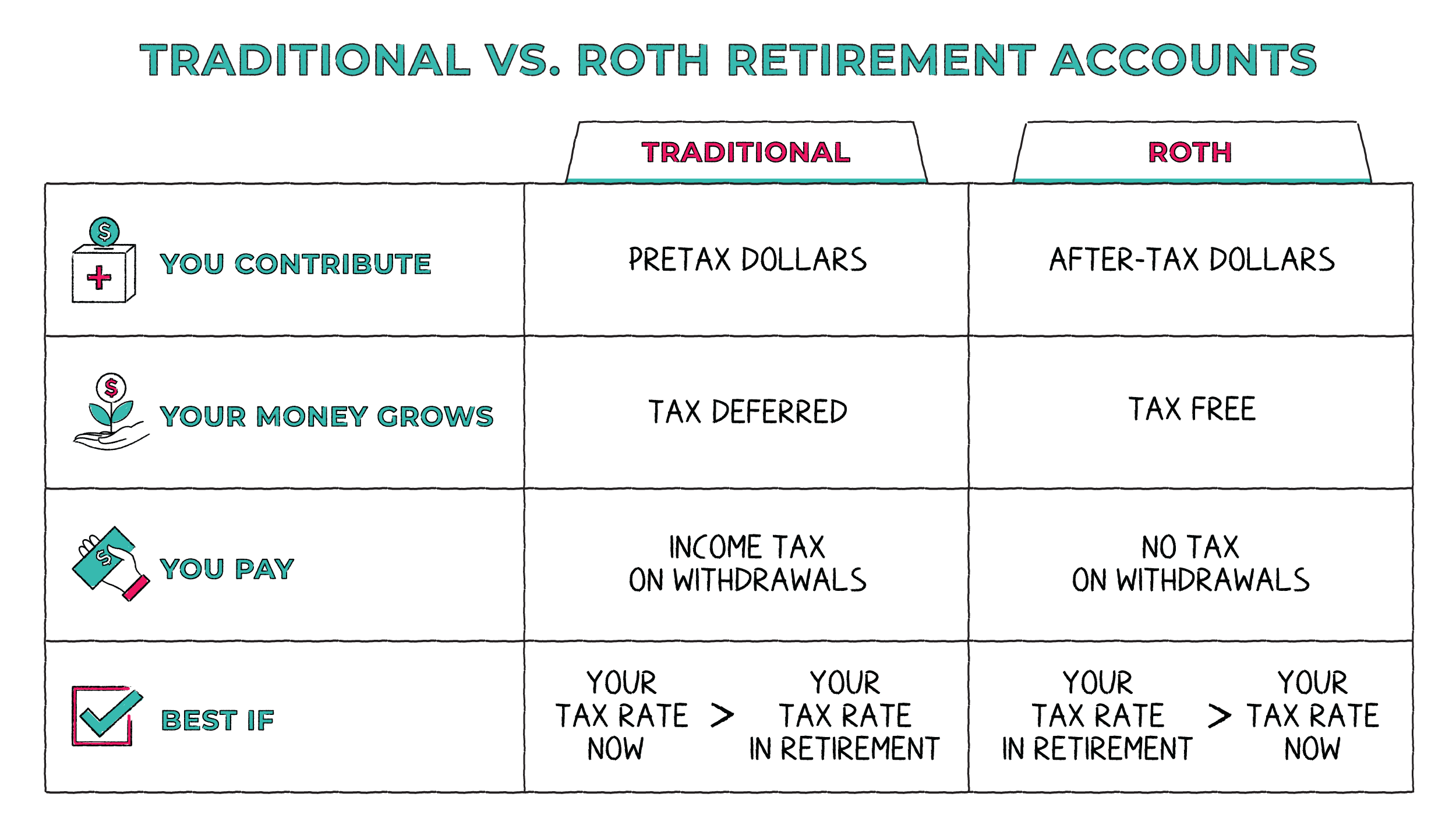

Remember as Joanne's 401K is a traditional IRA, this means everything that has been contributed is pre-tax and therefore taxation arises on the full lump sum. The net income Joanne will bring home is AUD$361,134. Australian Taxation Office Treatment. Taxable income (401K Withdrawal) AUD$480,322. Gross Tax Payable.

401(k) vs. 403b Chapter 7 What Is a 403b vs. 401(k)? Finance Bank

On today's Big Take podcast: Experts see Australia's pension system as a success story. But many Australians still worry they don't have enough saved.

401k vs roth ira calculator Choosing Your Gold IRA

The average age for retirement of this group was 62.9 years - men at 63.6 years and women at 62.1 years. But the figures also show that people retire for other reasons, for example, to care for someone, because of retrenchment or an inability to find work, or as a result of sickness, illness or injury.

Free 401(k) Calculator Google Sheets and Excel Template

Planning your retirement. Information and resources to help you plan your retirement. There are no rules about when to retire, but there are things you should think about before you make your decision. Before you retire you should consider: what kind of lifestyle you want to have. how much money you need. when you can access your super.

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance

You also need to meet: an assets test. If you're legally blind and you're not claiming Rent Assistance, you may be able to claim Age Pension without being assessed against the income and assets tests. You'll need to provide an ophthalmologist report to support your claim. If you're Age Pension age but don't meet all the rules for Age.

What is a 401(k) plan? A guide from Intuit QuickBooks

Tax Rates. In the US you pay very little or no tax on a retirement plan payout. Which tax rate applies depends on whether it is a 401k, Roth, or a different IRA. In Australia on the other hand, you pay marginal tax rates on your US retirement plan payout - no matter which type of IRA the payout comes out of. And so this can cost you a lot of tax.

Retirement Plan 401k

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

This means if you stop working in your mid-60s, you'll need retirement income for 20 years or more. Making a retirement plan can help you manage your finances, and cope better as your life and priorities change. Talk about your retirement priorities with a partner, colleague or friend. Get professional advice, if you need it.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

The two most convenient ways to retire to Australia are to apply for a Significant Investor or a Premium Investor visa. First of all, there is no age limit for Significant or Premium Investor Visa applications. Plus, you can apply for this visa either onshore in Australia or from your home country.

What Is a 401(k) Plan? Who Can Contribute, Pros & Cons

Retirement Tax in Australia. In Australia, there is no specific retirement tax, but there are a number of general taxes that apply to retirees, depending on the types of income you receive, the investments you own and how the investments are owned. This article explains the types of taxes a retiree might incur and when such taxes might be.

What is 401k Matching & How Does it Work?

Retirement years. Help and payments for when you retire. Information about planning for retirement. What to do if you decide to keep working past Age Pension age. Home.

Choosing Individual 401k Plans All That Glitters Is Not Gold

Age requirements. The pension age is being gradually increased from 65 to 67 years as set out in the table below. Period within which a person was born. Pension age. Date pension age changes. From 1 July 1952 to 31 December 1953. 65 years and 6 months. 1 July 2017. From 1 January 1954 to 30 June 1955.

What Is a 401k? What You Need to Know! (Understanding a 401(k) Plan Explained) AdvisoryHQ

But the average retirement age for women is 52. Women retire 7 years sooner than men on average, according to ABS figures. And Australians can expect to live to 85 for women and 81 for men on average (ABS, 2021). So this means your retirement savings may need to last up to 30 years, depending on what age you retire.

401k Defined and Explained Retire Simple Loanry

On this page. This calculator helps you work out: what income you're likely to get from super and the age pension when you retire. how contributions, investment options, fees and retirement age affect your retirement income. how working part-time or taking a break from work affects your super balance.

.