The Vital Steps In Liquidating A Company Company Liquidation

How to liquidate via members' voluntary liquidation. 1) Make a 'Declaration of Solvency' or complete 'Form 4.25'. Whether you make a 'Declaration of Solvency' or complete 'Form 4.25' simply depends on where your company is registered. If your company is based in England or Wales, you must make a Declaration of Solvency, if.

How to liquidate a limited company 2024 Guide

Hire a professional auctioneer and hold a public auction. Pay a business broker a fee to sell off your assets. File bankruptcy, in which case the bankruptcy trustee will sell your assets and pay off your creditors with the proceeds. Assign your assets and debts to a company that specializes in liquidating businesses.

What is company liquidation & when should a business liquidate?

Business liquidation is typically handled in one of three ways: Business assets are sold to one buyer, usually at a substantial discount. Assets are sold in an extended, liquidation sale process with ongoing discounting and multiple buyers. A competitive auction is conducted, generating the highest prices the market will produce, relatively.

Liquidation of a Company Muds Management

3. File an Article of Dissolution. Articles of dissolution is a document in which you ask the state to officially dissolve your business. Find the form at your state's corporations division or.

Company Liquidation Explained YouTube

People may liquidate their assets for various reasons: Financial Struggles: If facing issues like debts, job loss, or unexpected bills. Large Expenses: To fund significant purchases like a home or business venture. Divorce Settlement: In cases where assets need to be divided or sold. Investment Decisions: Getting out of a risky investment or rebalancing a portfolio.

How Much Does It Cost To Liquidate A Company Marie Thoma's Template

1. Emotional and Financial Readiness. Parker emphasizes the importance of being emotionally and financially prepared for liquidation. "It's a process that demands mental fortitude and clear.

How to Liquidate a Company in DIFC DIFC Liquidation

The process and procedure for liquidating a limited company, also known as winding up, typically involves the following steps: Board Resolution: The company's directors must pass a resolution to wind up the company voluntarily. Declaration of Solvency: If the company is solvent (able to pay its debts in full), the directors must make a.

Sample Corporate Plan Of Liquidation

Liquidation is the process of selling a business's assets to produce enough cash to pay back creditors. It ends in the business closing. If a company is not able to make ends meet, liquidation is one option to pay creditors and close the business. Liquidation is just one business exit strategy option. An exit strategy is how you plan on.

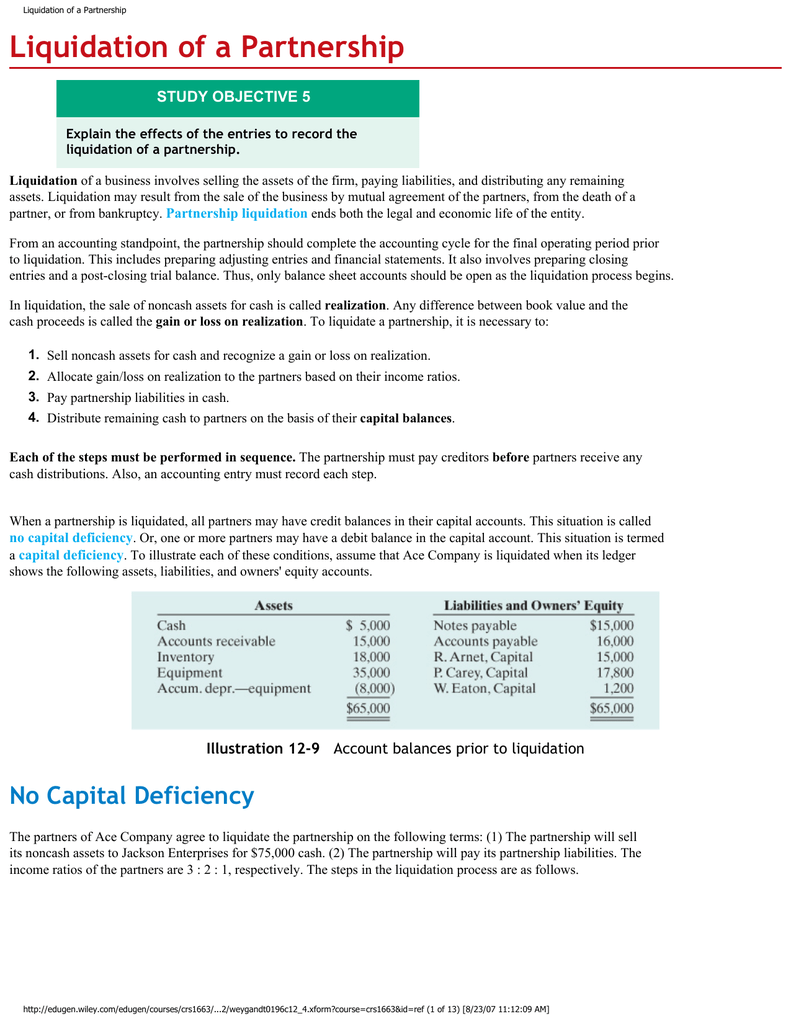

Liquidation of a Partnership

Shareholders who immediately before the first liquidating distribution own 1% or more (by vote or value) of a private corporation, or 5% or more (by vote or value) of a public corporation, must include a statement on or with their tax return. This statement is titled: "Statement pursuant to § 1. 331 - 1 (d) by [insert name and taxpayer.

Liquidate a company 力传

If you are considering liquidating or closing your limited company get in touch with us today for some FREE advice on which is the right route for you. We'll let you know your options and what you need to do next. Call us for free (mobiles and landlines) on 0800 975 0380 or email advice@forbesburton.com. Find out how to liquidate a company.

Guide to the Limited Company Liquidation Process Forbes Burton

Liquidation is the process of closing down a business permanently and distributing all of the business's assets to shareholders, creditors, and claimants. This process can be done either voluntarily or involuntarily and usually occurs when the business cannot pay its debts back in time. An insolvency professional (IP) is the official.

How Long Does It Take To Liquidate A Company? Wilson Field® Licensed Insolvency Practitioners

You must prepare a sales agreement to sell your business officially. This document allows for the purchase of assets or stock of a corporation. An attorney should review it to make sure it's accurate and comprehensive. List all inventory in the sale along with names of the seller, buyer, and business.

5 Tips To Effectively Liquidate Your Business Assets Shawano Leader

Company liquidation costs. Liquidating a company involves several costs that need to be considered. Here are some potential costs associated with company liquidation: Liquidator's fees: one of the primary costs is the fee charged by the appointed liquidator for their professional services. Liquidators charge fees based on the complexity of.

Cost to liquidate a company KGRN Auditing & Accounting

Business liquidation is the direct conversion of assets to cash or cash equivalents by selling them to a user or consumer. Liquidation is typically an option if your business is insolvent and can't pay its bill or debts. When your business is liquidated, any remaining assets are paid to creditors and shareholders.

WHAT IS COMPANY LIQUIDATION?

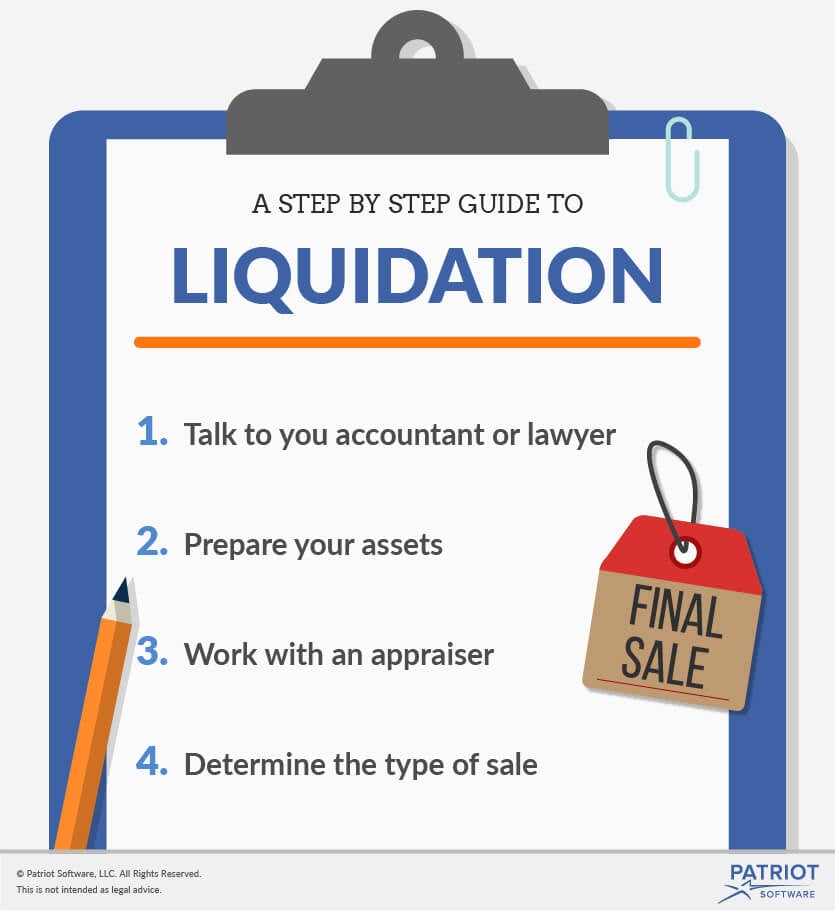

The following is a quick overview of the steps involved in liquidating assets. 1. Don't do anything without professional advice. If your liquidation involves formal insolvency, you'll need the services of an Insolvency Practitioner (IP) to help draw up a liquidation plan. Your plan will need to be accepted by a majority of your remaining.

Liquidation Process of a Company Meaning, Forms and Procedure

Liquidate means to convert assets into cash or cash equivalents by selling them on the open market. Liquidate is also a term used in bankruptcy procedures in which an entity chooses or is forced.

.